THINKING

OUTSIDE THE BOX

It's your money ... end

the state income tax

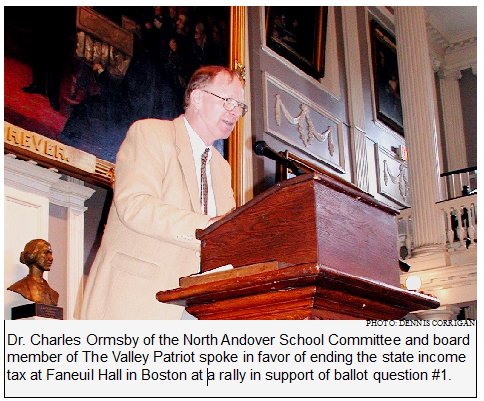

Dr. Charles Ormsby

On November 4th you will

have an opportunity to reclaim an average

of $3,700 of YOUR money every year, year

after year after year. This is money that

you have earned and that is currently

taken out of your paycheck every payday

by the Massachusetts Department of

Revenue. It is your money. But it is

being taken from you to line the pockets

of special interests. On November 4th you will

have an opportunity to reclaim an average

of $3,700 of YOUR money every year, year

after year after year. This is money that

you have earned and that is currently

taken out of your paycheck every payday

by the Massachusetts Department of

Revenue. It is your money. But it is

being taken from you to line the pockets

of special interests.

Over the next month you will hear the

panicked screams of those who have become

comfortable at your expense. They will

threaten to take away police and fire

protection and they will tell you that

your children will no longer have

teachers, books or … well, they may

not even be fed!!

They will tell you every lie they can

manufacture to scare you into parting

with your earnings while continuing to

fund their gravy train. These lies will

be broadcast in ads paid for almost

exclusively by union contributions. As of

August 31st, the “Vote No”

coalition had received over $1.5 million

from public employee unions, but only

$100 from a single individual. More

than $5 million in union ads urging a

“no vote” is expected before

November 4th.

Of course, these unionized government

employees and government contractors are

screaming bloody murder! They have

arranged a sweet deal that they could

never command in a free market … and

they want to stick you, your children,

and your grandchildren with the bill.

Is this the kind of government you want

to support?

* Guaranteed jobs that can’t be lost

even based on pathetic performance or a

lack of attendance1

* Jobs with extravagant healthcare

coverage paid 80-90% by the taxpayers

* High, guaranteed-benefit pensions with

full healthcare coverage after a mere 20

years of service

* Thousands out on questionable

disabilities2

* Guarantees of “prevailing

wages” which only prevail in

government contracts because real

competition is absent

* Make-work jobs doled out to special

interests without competitive bidding and

often staffed at overtime wage rates

(e.g., police road details)

Extravagant, wasteful, non-competitive

personnel costs, driven up by government

unions, are only the tip of the iceberg.

The special interests also recognize that

many government programs paid for with

your income tax dollars are not needed at

any price. These expenditures represent

pure waste: No-show jobs for the

brother-in-laws of politicians,

overlapping police forces, and

agencies/programs for every conceivable

purpose. In fact, many programs actually

cause substantial harm!

You might ask yourself: How does our

Division of Insurance make your life

better when we have nearly the highest

car insurance and health insurance

premiums in the nation?

Call your state representative and ask

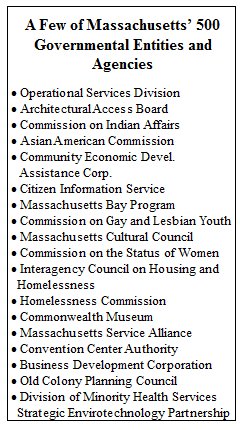

him or her why the state

agencies/departments listed in the nearby

box should be more important to you than

keeping the $3,700 currently taken from

you in income taxes.

This list of departments/agencies could

go on for pages … If you go to the

Mass.gov Web site you will find 500

such entities listed.

Some of you may read this list (or the

whole list) and say, “These sound

worthwhile.”

Do you support spending on all these

departments/agencies? Really? Are you

sure?

OK, I confess. One of those listed in the

box (but only one) is a fake. Can you

pick it out? The answer is at the end of

this article. I wonder if your state

representative or senator can tell you

which one doesn’t exist?

But they all sound like good ideas,

don’t they? Do you think anyone will

ever create an agency called The

Massachusetts Department of Does-No-Good?

Of course not. Every department and

agency has penned a name that seems

important, valuable, and even

indispensable. That is how they build a

constituency and protect themselves from

budget cuts or, heaven forbid,

elimination.

Elimination! Oh my God! So how often are

Massachusetts agencies eliminated? Almost

never. But one was recently eliminated:

The Office of Educational Quality and

Accountability.

It makes sense doesn’t it? We spend

over $10 billion every year on education

in Massachusetts, but we wouldn’t

want quality or accountability would we?

Do you think the teachers unions or

superintendents association might have

wanted this agency eliminated? Do you

smell foxes in the chicken coop?

Just consider these statistics: 5,500 new

state employees over the last five years;

2,000 just in the last year; prison

guards earning over $100,000; thousands

of government employees enjoying lifetime

disability gravy trains, on and on. Noone

has a complete list. It would take a

government agency just to catalogue

… well, I guess that is a bad idea!

It is embarrassingly obvious:

Massachusetts government is bloated,

wasteful, corrupt, and run for the

benefit of government employees and

special interests. NOT for the average

citizen like you and me.

But that still leaves a question that

must be answered: What budget level would

be adequate for Massachusetts?

There is only one way to figure this out.

Clearly, the average citizen can’t

research every department, agency and

program to decide where funding should be

reduced or eliminated. We certainly can

not depend on advice from those working

in these organizations or those who

benefit from related funding because they

have a conflict of interest. The only way

to determine an adequate budget/spending

level is to look at the best of the other

49 states. (We do want to be “the

best,” don’t we?)

Arkansas or Mississippi may not appeal to

Massachusetts voters as good models, but

New Hampshire does provide as good an

example as one could have. We are

contiguous states, we have a similar

climate, and we share similar lifestyles.

In fact, New Hampshire seems very

attractive to Massachusetts residents as

evidenced by a substantial migration out

of Massachusetts and into New Hampshire.

So how does New Hampshire’s

government spending, corrected for

population, compare to Massachusetts?

If the Massachusetts income tax is

eliminated, the total of our state and

local taxes, on a per capita basis, will

merely drop to just above (YES, ABOVE)

the level that currently exists in New

Hampshire, the fastest growing state in

New England.

Here are the current state and local per

capita tax burdens in New Hampshire and

Massachusetts from the U.S. Department of

Commerce and the Census Bureau:

• Massachusetts: $5,203

• New Hampshire: $3,321

• Difference: $1,882 more in

Massachusetts for every man, woman and

child.

When you multiply this difference by the

population of Massachusetts, you get over

$12 billion, which is more than the

projected reduction in tax revenues if

our state income tax is eliminated.

Your representatives will tell you that

they can’t do it. Tell them,

“Do it or get out.”

Current spending by the Massachusetts

state government totals approximately $47

billion including “off-budget”

expenditures. This total includes

revenues received from federal

reimbursements/grants, lottery proceeds,

license fees, investment earnings, etc.

… all of which will continue if the

income tax is eliminated.

If Question 1 passes, spending by our

state government would drop to $35

billion. This amount does not count local

spending based on property taxes totaling

approximately $20 billion. Thus, a grand

total of $55 billion in government

spending will still be available in

Massachusetts for essential services if

the income tax is eliminated.

Shouldn’t $55 billion be sufficient

to fund police, fire, and education -

with substantial sums left over?

After Question 1 passes, our state

Legislature needs to create a zero-based

budget strategy. Start by funding police,

the courts, fire, and education. Then

prioritize what is left. When the money

runs out … STOP!!

If our legislators need to create greater

savings to fund these essentials, then

eliminate compulsory bargaining and the

prevailing wage scam. Our Legislature

needs to work for the taxpayers, not for

the special interests. Passing Question 1

is the only way to force them to do

so.

It is as simple as that.

Don’t be intimidated by threats and

lies.

VOTE YES ON QUESTION ONE. Then, enjoy

your hard-earned money and insist that

essential services be funded.

Oh, yes, there is no Division of Minority

Health Services. But if Question 1 does

not pass, I’m sure there will be.

(Footnotes) 1 One state cop was recently

caught calling in sick to run his fishing

business on Cape Cod. 2 A fireman on

long-term disability was recently caught

in a body-building competition.

Dr. Ormsby is a member of the North

Andover School Committee. He is a

graduate of Cornell and has a doctorate

from MIT. You can contact Dr. Ormsby via

email: ccormsby@comcast.net

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

All

pictures and material are

(C) copyright, Valley Patriot, Inc., 2008

|